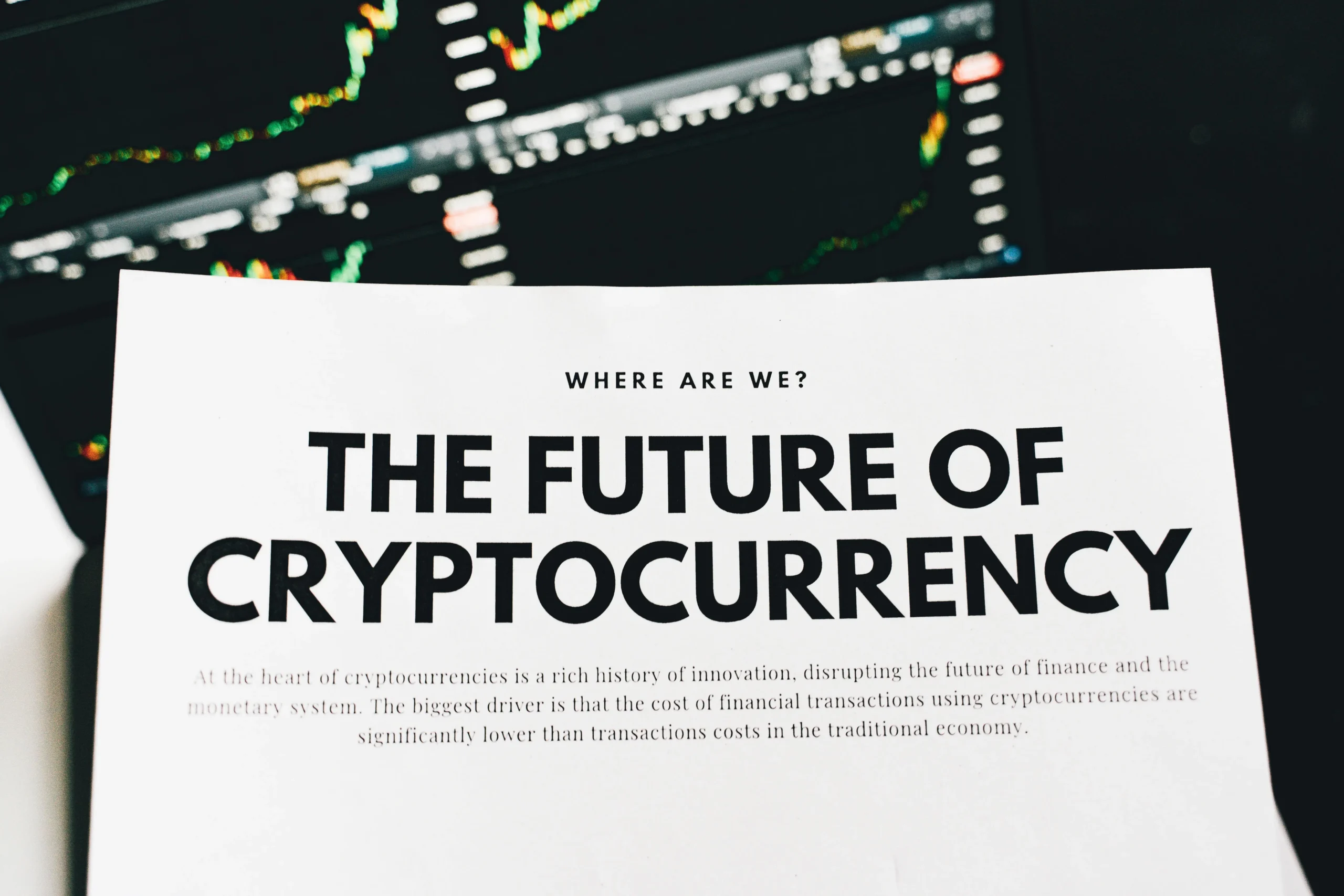

The Future of Cryptocurrency: Trends and Predictions

Cryptocurrency has transformed the financial landscape since Bitcoin’s inception in 2009. As the digital currency market continues to evolve, its future holds both promise and challenges. In this article, we’ll explore the emerging trends, potential developments, and the overall outlook for cryptocurrency in the coming years.

1. Increasing Mainstream Adoption

One of the most significant trends shaping the future of cryptocurrency is its increasing acceptance by businesses and consumers. Major companies like Tesla, PayPal, and Square have started accepting cryptocurrencies as a form of payment, which enhances legitimacy and encourages further adoption. As more businesses recognize the benefits of cryptocurrencies—such as lower transaction fees and faster cross-border payments—this trend is likely to continue.

2. Regulatory Developments

Regulation is a double-edged sword for the cryptocurrency market. On one hand, clear regulatory frameworks can enhance security and protect consumers, fostering greater trust in digital currencies. On the other hand, excessive regulation could stifle innovation. Countries around the world are grappling with how to regulate cryptocurrencies, and the outcomes will significantly impact the industry. Expect more clarity and legislation in regions like the European Union, the United States, and Asia, which will shape the landscape for investors and companies.

3. Technological Advancements

The future of cryptocurrency will also be driven by technological innovations. Developments in blockchain technology, such as scalability solutions and interoperability between different blockchains, will enhance the efficiency of transactions. Projects like Ethereum 2.0 aim to improve speed and reduce energy consumption, addressing some of the criticisms associated with cryptocurrencies. Additionally, the rise of layer-2 solutions and sidechains could further streamline operations and reduce costs.

4. Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies are gaining traction as governments explore the benefits of digital currencies. Countries like China, Sweden, and the Bahamas have already launched or are testing CBDCs. While CBDCs differ from traditional cryptocurrencies in that they are centralized and regulated by governments, their emergence could lead to greater acceptance of digital currencies overall. As CBDCs become more prevalent, they may coexist with decentralized cryptocurrencies, creating a diverse digital currency ecosystem.

5. Decentralized Finance (DeFi)

DeFi has emerged as a revolutionary trend within the cryptocurrency space. By eliminating intermediaries, DeFi platforms offer financial services like lending, borrowing, and trading directly on blockchain networks. The growth of DeFi projects has attracted significant investment and user interest, and this trend is expected to continue. However, as DeFi matures, regulatory scrutiny will likely increase, pushing for more security and transparency in this rapidly evolving space.

6. Enhanced Security Measures

As the cryptocurrency market grows, so does the threat of cyberattacks and fraud. The future will likely see advancements in security protocols and technologies to protect digital assets. Multi-signature wallets, biometric authentication, and decentralized identity solutions will become more common as users seek safer ways to manage their cryptocurrencies. Education around security best practices will also play a vital role in protecting investors from scams.

7. Environmental Concerns and Solutions

The environmental impact of cryptocurrency mining, particularly with proof-of-work systems like Bitcoin, has come under increasing scrutiny. In response, the industry is exploring more sustainable alternatives. Proof-of-stake and other eco-friendly consensus mechanisms are gaining popularity, and projects are emerging that focus on carbon neutrality. As environmental concerns continue to shape public perception, the industry will need to prioritize sustainability to gain broader acceptance.

8. Evolving Investment Landscape

Cryptocurrency is becoming an integral part of diversified investment portfolios. As institutional investors and hedge funds enter the space, the dynamics of the market are changing. Products like Bitcoin ETFs (Exchange-Traded Funds) will likely become more common, making it easier for traditional investors to gain exposure to cryptocurrencies. This influx of institutional capital could stabilize the market and reduce volatility over time.